|

How Many Fulfillment Centers are Needed for Amazon to Achieve Same Day Delivery to the Top 20 U.S. Cities?

Supply Chain Digest Blog Entry: September 3, 2013 (here)

For the past few years, Amazon has been on a relentless pursuit to reduce the time that it takes to deliver customer sales orders. The company has invested hundreds of millions of dollars into fulfillment centers positioned close to U.S. major metropolitan markets to enable shipments to be delivered in hours rather than days. Ultimately, time will tell if this strategy is a game changer that will revolutionize the e-commerce market as we know it. For the moment, we thought it would be of interest to understand how close Amazon is towards achieving their same day delivery goal within the U.S. market.

So the question is how close to reality is Amazon Same Day Delivery? To answer this question with a reasonable degree of accuracy, we need two important sources of data:

- Census information on U.S. population statistics by major metropolitan city.

- Information on Amazon's existing fulfillment network.

We also need to make an assumption about the maximum distance that is appropriate for a fulfillment center to provide same day delivery service. We have census data from 2010 and we also have a detailed listing of all Amazon fulfillment centers which is available here. For the purpose of this article we will assume a 100 mile radius as being the maximum distance around the fulfillment center to realistically achieve same day local delivery service. Why?

- If a driver can travel down a highway at an average speed of 50 miles/hour then 4 hours of time is needed to travel the return distance to/from the trading area perimeter which leaves say 4 hours to perform actual customer deliveries and 2 hours for break time, yard time, etc before a 10-hour work-day is reached.

- The "cost of the last mile" discussion is crucial to the concept of same day delivery. There needs to be a minimum "hit density" on a driver's route to achieve a low cost per delivery. We discuss last mile issues here but suffice to say that if the radius of distance gets larger than 100 miles then we spend more time driving and less time delivering. This in turn increases the cost per shipment and penalizes the viability of the same day service proposition. In fact, I am certain that many logistics experts would challenge our 100-mile assumption and suggest that a 50-75 mile radius is a better distance to use so we are likely being conservative.

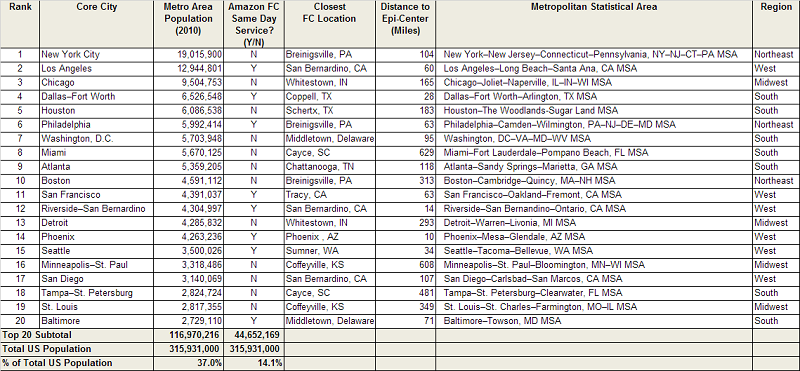

Let's take a look at the 2010 census data for the top 20 cities in the U.S. sorted in descending population sequence to get the ball rolling. In the table below the population statistics reflect the number of people living in the greater metropolitan region of each city including surrounding areas. At the bottom of the table we can see that the top 20 cities total nearly 117 Million people which accounts for 37% of the 2010 U.S. population of 316 Million people.

For each of the top 20 cities, we identify the nearest Amazon fulfillment center and its approximate distance to the epi-center of the metropolitan area. As an example, the largest U.S. metropolitan population is New York City at 19 Million people which includes surrounding cities in NJ, CT, NY and PA. The nearest Amazon fulfillment center to this megalopolis is in Breinigsville, PA where two Amazon facilities are located (ABE2 & ABE3). The distance from these facilities to the center of Manhattan is 104 miles which exceeds the 100 mile maximum radius assumption that we defined earlier on, hence we state that Amazon is not currently in a position to provide same day service to New York City. This will of course change if the company starts up distribution operations in Robbinsville, NJ which is 58 miles away from Times Square, but as of 2013, based on our 100 mile assumption, we categorize New York City as a city that is not same-day ready.

Within the list of top 20 cities, we have identified eight (8) urban centers where Amazon is already within a 100-mile radius (as of August 2013) and 12 cities where Amazon is not positioned to provide same day service. The one exception to our 100-mile rule is Washington DC which is 95 miles from the Amazon fulfillment center in Middletown, DE, but the reality is that the southbound and northbound traffic along the I95 is horrific and it would be futile to service Washington DC from this location on a same day basis (Ed. note: subsequent to this blog posting, Amazon announced a new fulfillment center to open in 2014 in Baltimore, MD which is 42 miles from the center of Washington DC).

Thus from the table above, we might conclude that as at Q3 2013, Amazon has a distribution infrastructure that can provide 44.6 Million people or 14.1% of the US population with same day delivery service. In fact the percentage is slightly higher because Amazon also has existing fulfillment centers positioned nearby: Indianapolis, IN; Reno, NV; San Antonio, TX; Chattanooga, TN; Nashville, TN; Louisville, KY; Cincinnati, OH; Columbia, SC; Richmond, VA; Harrisburg, PA; and Allentown/Bethlehem, PA. These cities total 4.3 Million in population hence Amazon's same day reach is currently closer to between 49 - 50 Million people or 15.5% of the population.

Thus to be in a position to service the top 20 cities that account for 37% of the US population, Amazon needs to add about 12 fulfillment centers to its existing distribution network of 53 fulfillment centers in the U.S. for a total of 65 buildings nationwide. The table above illustrates the cities where we can most likely expect these new fulfillment centers to be added. Assuming that the average new fulfillment center size will be in keeping with the facilities that have been added over the past couple of years (i.e. 1,000,000 sq ft at $110 per sq ft) Amazon will need to add a minimum of 12 Million square feet at a price tag of $1.3 Billion. In reality, the investment will likely be higher as some cities will need more than one facility and the buildings are getting bigger and more expensive over time. Most importantly, this forthcoming spending spree does not even begin to address the distribution infrastructure requirements of Amazon.Fresh since this will require a completely parallel set of distribution facilities to support perishables distribution.

In conclusion, as of Q3 2013, a minimum of 12 more fulfillment centers is needed for Amazon to achieve same day delivery to the top 20 cities that account for 37% of the US population. Click here for a discussion on the economic challenges associated with last mile delivery and why being closer to market does not necessarily translate into lower outbound transportation costs in the world of e-commerce.

Marc Wulfraat is the President of MWPVL International Inc. He can be reached by clicking here. MWPVL International provides supply chain / logistics network strategy consulting services. Our services include: supply chain network strategy; distribution center design; material handling and automation design; supply chain technology consulting; product sourcing; 3PL Outsourcing; and purchasing; transportation consulting; and operational assessments.

|