|

Background Information

The grocery industry is one of the most challenging industries from a logistics perspective. Food is the product type that humans consume the most of which is why grocery distributors ship high cubic volumes of merchandise to retail stores with frequent deliveries to ensure product freshness. Grocery distribution center operations are amongst the most labor intensive of any industry and the work is physically demanding with associates handling heavy cases and working at high speeds throughout the day in ambient, refrigerated and freezer environments.

In North America, most grocery retailers and wholesalers are lucky to make a 2% net margin after it’s all said and done - that’s two cents on the dollar if you’re good because many survive on less. Add it all up and one might suppose that automation in grocery distribution centers must be fairly common, but nothing could be further from the truth. The vast majority of North American grocery distribution centers are conventional operations meaning that people do the work, primarily by moving merchandise with manual handling and the use of pallet jacks and forklift trucks. This article takes a look at the grocery companies that have made bold initiatives to automate their distribution centers and we attempt to explain why the industry as a whole remains characterized by conventional warehousing strategies.

Automation in the Grocery Industry - A Look Back in Time

In the beginning, the first automatic carton selection system was the SI Ordermatic manufactured by S.I. Systems of Easton, PA. The Ordermatic was a massive machine that was used, primarily in large grocery distribution centers, to automatically and precisely select full cases instead of having people doing order selection. In the late 1970’s and 1980’s, grocery companies were eager to automate as a labor strategy resulting from increasing levels of organized labor and high inflation rates causing significant increases in labor wages and benefit expenses.

- In the 1980’s, Giant Food deployed a 662 feet long Ordermatic machine in their Landover, MD distribution center. The machine automatically picked dry grocery cases for 150 stores at a rate of 5,000 cases per hour from among the 15,000 pallets stored in the system. A computer system would instruct gate release mechanisms (set up at the SKU level) to dispense full cases down short ramps and onto three levels of conveyor belts. At the time, it was a revolutionary and bold approach to replacing approximately 26 order selectors from doing the same work conventionally. It was one of the last Ordermatics to be unplugged in the U.S.

- In 1984, Fleming Cos. took a $4 Million write-off when it removed its SI Ordermatic from its 478,000 sq. ft. Philadelphia distribution center. The depot was converted to a conventional operation because the automated system ‘had not proved to be as productive as originally anticipated.

- Spartan Stores used a 30’ high SI Ordermatic (known as Big Blue) at their Grand Rapids dry grocery distribution center until it was discontinued in 1987.

Unfortunately, the Ordermatic was a first generation technology that suffered a setback due to the general degradation of case-packaging in the food industry. The system was not effective at handling oversized or undersized cases, film-wrapped cases tray pack containers that do not slide easily down the system’s plastic runners, and weak unstable cases. In addition, the effort required to replenish the Ordermatic’s pick slots was often problematic depending on the methods used to perform replenishment and the quad configuration of the machine. If pick slots were not replenished on time then the order would be short shipped and the Ordermatic was known for being able to pick product faster than it could be replenished. In the end, the Ordermatic was never widely deployed because of the reality that it was difficult to realize a reasonable return on investment.

Another system developed by SI Systems is the CARTRAC which is still in use today primarily in manufacturing operations such as automotive assembly operations. The S.I. CARTRAC method was designed to move pallets of product to the operator rather than having the operator travel the aisles selecting orders. The CARTRAC concept basically consists of a train of carts that continuously travel through a loop such that operators positioned at pick stations along the track can select their orders without having to travel. After pallets are received, the forklift operator stops the CARTRAC and places the inbound pallet onto an empty cart after removing the empty pallet. The CARTRAC then proceeds to travel its designated circuit in the warehouse and operators select cases as the pallets pass by. The CARTRAC concept was deployed in Produce rooms where SKU variety is low and case movement is high with the benefit being the elimination of selector travel time. Unfortunately, the downside is that the system is only as fast as the slowest selector and as a result the CARTRAC system was not a success in the grocery distribution context.

In the 1970’s and 1980’s, most grocery distribution centers were either designed as conventional operations or as mechanized (pick to belt) operations. The problem with most full case pick to belt operations in the grocery trade was that the net labor savings was minimal as compared to conventional operations meaning that there was nothing but additional expense to pay for maintaining and operating the conveyor equipment - a steep price tag that led to many conveyor systems being ripped out after only seven years of usage. Quite simply, if an operator picks 400 cases/hour to a belt and another operator removes cases and stacks pallets at a rate of 300 cases per hour then the net throughput rate is 171 cases/hour. A selector who conventionally picks dry grocery cases to a double pallet jack in a typical retail grocery distribution center can work at a pace of 175 - 200 cases per hour so the cost benefit equation for mechanized picking is not obvious, especially when faced with a $1 Million system maintenance expense to replace worn out equipment.

Automation in the 1990’s and Beyond

By the early 1990’s, the trend towards automation in the grocery industry slowed down as inflation rates normalized and the fears of a runaway labor crisis of the 1980’s subsided. During the 1990’s, few grocery companies invested in automation solutions and those that did were inclined to invest into automated storage and retrieval systems (AS/RS). The early generations of AS/RS machines were much slower and more expensive than the machines that are currently available to the market. In the early years, investing in AS/RS machines required a much greater leap of faith because the biggest fear was that the machines could not move the pallets fast enough to support picking operations.

During the 1990’s, man of the AS/RS systems deployed were put into freezer operations whereby the AS/RS machines performed all pallet moves such as putaway, letdown and full pallet picks. Initial throughput rates for these machines were in the range of 10 pallets per hour in and out so they were not practical solutions for faster velocity environments. Nowadays, throughput rates are upwards of 40 pallet moves per hour which has essentially mitigated this issue. In the past decade, AS/RS machines have been successfully deployed across all storage environments including Dry Grocery, the Dairy/Deli refrigerated cooler, the Produce rooms, the Fresh Meat room and the Freezer. A few of the Grocery retailers and wholesalers who have deployed AS/RS systems follow:

- Stop and Shop deployed 77 HK3000 (Dematic) rotating fork AS/RS machines in its 35’ high 1.3 Million Square Feet distribution center across its Dry Grocery, Produce, Fresh Meat and Dairy/Deli coolers in Freetown, MA. What is unique about this facility is that all of the cranes are deployed in a single deep racking environment whereby man and machine work in very close proximity; the AS/RS literally passes human hands within a matter of inches (most AS/RS applications are deployed in 2+ deep pallet rack storage systems).

- Publix Super Markets deployed three AS/RS systems between 1994 and 2005 in its freezer rooms in Deerfield Beach, FL (supported by mechanized pick to belt conveyors) and Lawrenceville, GA (2-level manual pick) and their Lawrenceville, GA slow moving Dry Grocery operation (mezzanine pick to belt with sortation). Publix commissioned Swisslog to design and implement automation for a new 1,000,000 sq. ft. distribution center in Orlando which opened in 2015. The project involves the latest Swisslog Vectura AS/RS stacker cranes, automated delayering machines and a unique 2-level split tray picking order fulfillment technology deployed in the freezer facility.

- Wegman’s Food Markets has implemented AS/RS machines supported by mechanized order selection in their Dairy/Deli cooler and Freezer, and in the Fresh Meat depot in their Rochester, NY campus of facilities. They also operate ASRS machines in their Pottsville, PA Dry Grocery depot.

- Associated Food Stores deployed a 4 crane AS/RS within a 52,000 square feet expansion of their Dairy/Deli cooler in Farr West, Utah. What is interesting about this installation is that a 2-level rack-supported mezzanine is used to enable pick facings for high variety Dairy/Deli SKUs to be picked at floor level across two levels with AS/RS miniload machine providing replenishment support for both levels.

- Fareway Foods is a small grocery retailer with stores in Iowa and Nebraska. The company built their first distribution center in Boone, IA, a $32 Million refrigerated facility with 263,000 square feet that includes an 8-level AS/RS system. What is important about this installation is that Fareway Foods is a relatively small supermarket retailer that had the courage to make the investment into distribution automation when much larger companies have not. It is our understanding that the company will be expanding its automated facility in the near future.

- H.E.B. has deployed AS/RS machines across multiple distribution centers including its 60’ high 780,000 square foot HBC/GM/Slow Moving Grocery distribution center in San Marcos, TX. This facility also includes tote sortation equipment from Daifuku that ensures the heaviest totes are always placed on the base of the pallet. H.E.B. has also deployed a rack supported freezer expansion from Dematic in their San Antonio campus of facilities.

- C & S Wholesale Grocers has invested significantly into automation in its 1.5 Million Square Feet York, PA ES3 LLC Mixing Center that services distributors throughout the Northeast with pallets, layers and cases. Their new automated case selection and automated gantry robot palletization system was developed and implemented with SSI Schaefer USA (SCP - Schaefer Case Picking) which went live in 2010-2011. See below for more information on automation in the C&S Newburgh, NY distribution center.

- Since 2000, Walmart has worked with Swisslog on an MDC (Mechanized Distribution Center) Program to mechanize and automate a number of its Chilled and Frozen distribution centers in Brundidge, AL; Arcadia, FL; Sterling, IL; Gas City, IN; Lewiston, ME; Bartlesville, OK; Pottsville, PA; New Caney, TX; Cheyenne, WY; and San Martin Obispo, Mexico. The standard configuration consists of a frozen and refrigerated high bay warehouse containing 35,000 pallet positions and 18 AS/RS stacker cranes doing the putaway and replenishment work. Operators work on a three-level mezzanine using pick to pallet voice order selection. SKUs are slotted in one-level and two-level full case pick slots and shipment volume is roughly 200,000 cases/day.

- Since 2007, Target has worked with Swisslog to roll-out two food distribution centers with their ATLAS Program. Target has built 2 perishables (frozen and refrigerated) distribution centers in Lake City, FL and Cedar Falls, IA. The facilities have a high bay warehouse with 18 AS/RS stacker cranes doing the putaway and replenishment work. A “CaddyPick” system is used on a two-level picking mezzanine with 98 weight-sensitive caddies (39 in the freezer and 59 in the cooler) designed to detect case weights being selected. As well, two de-layering robots (gantry arms) are used to place products into smaller split trays. This allows 2-3 products to be presented in any given pick slot for better pick face density which helps to reduce the pick line by 35%. Caddypick is a patented Swisslog solution for picking that consists of a caddy that travels through all 14 pick aisles on overhead rails. Operators select cases to the caddies and then the caddies drop-off orders to the shipping conveyor system. In more recent years, Target has worked extensively with Witron to roll out several fully automated perishables distribution centers in Denton, TX; West Jefferson, OH; and Rialto, CA.

|

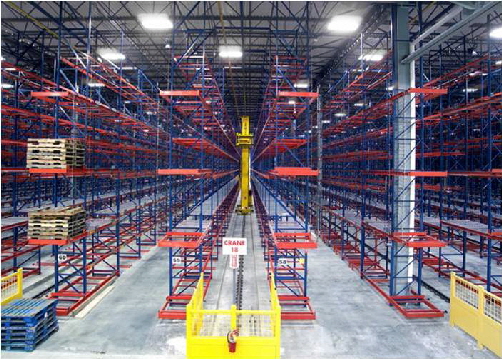

The Stop & Shop Freetown, MA Distribution Center has 77 AS/RS Cranes from Dematic

Perhaps the most important automation innovation to arrive on North American soil as far as grocery distribution is concerned is an automated full case selection system developed and integrated by Witron. In Europe, Witron has already successfully designed and implemented its automation solutions for split case distribution centers with companies like SPAR, Edeka, Migros, Mercadona, Sainsbury’s, Delhaize and others. The business case for automation in Europe has always been stronger than North America because of land constraints, higher labor costs and labor availability issues. In North America, these issues are less prevalent making it more difficult to economically justify the investment into fully automated distribution centers. Having said this, a number of Witron facilities have now been successfully been deployed in North America (and they are very impressive) including:

- In 2002, The Kroger Company went live with Witron’s Dynamic Picking System (DPS) for slow moving HBC/GM piece pick operations in its 725,000 sq. ft. Cleveland, TN Peyton’s Southeast distribution center. By 2009, Kroger rolled out its second Witron DPS system in its 1.2 Million sq. ft. Blufton, IN Peyton’s Northern distribution center.

- In 2001, The Kroger Company started working with Witron to design the first automated full case picking system which was successfully implemented in three phases starting in 2004 in its 1.1 Million sq. ft. distribution center in Tolleson, AZ. The systems comprises of 10 AS/RS cranes to manage 21,000 pallets of reserve inventory; 32 mini-load AS/RS OPM (Order Picking Machine) devices that manage 400,000 tray positions to support automated picking; and automated transfer vehicles that deliver pallets from systems induction to the AS/RS crane system. 16 Witron COMs (Case Order Machines) automatically stack cases onto pallets in a store friendly sequence with highly sophisticated Witron-developed robotic pallet-building software and machinery. The system ships an average of 110,000 cases/day with a peak capacity of 160,000 cases/day. This was truly a pioneering game-changing historically important event in automated distribution.

- In 2006, Kroger and Witron implemented the OPM full case automation system with 16 COMs at the 850,000 sq. ft. King Sooper’s distribution center in Aurora, CO. In 2009, the Ralphs/Food4Less division of Kroger started shipping Dry Grocery cases from its new automated full case Witron system with 20 COMs from its 559,000 sq. ft. distribution center in Paramount, CA. The first fully automated case selection facility for Perishables and Frozen Food (with 15 COMs) is in Kroger’s (Ralphs/Food4Less) 80’ high Compton, CA distribution center which opened in 2011.

- In 2006, SuperValu and Witron implemented the OPM full case automated distribution system within an existing retrofit facility (a 579,000 sq. ft. Hopkins, MN distribution center) and also the Witron DPS (Dynamic Picking System) for split case picking in a 1.25 Million sq. ft. Albertson’s Brea, CA distribution center. The latest distribution center to be retrofit for Witron’s automated full case selection for Dry Grocery is in the former Albertsons/ACME facility which is 1.7 Million square feet in Lancaster, PA.

- In Canada, Sobey’s Inc. went live in 2009 with a Witron OPM automated full case 510,000 sq. ft. Dry Grocery distribution center (65 feet high) in Vaughan, Ontario, Canada. The operation currently averages about 100 - 125,000 cases/day with 16 COMs and is capable of shipping up to 320,000 cases/day. This facility is one of the most automated and technologically advanced of its kind and the good people at Sobey’s have been kind enough to share their experience with an excellent video that is available here. In 2013, Sobey’s deployed a second fully automated 470,000 sq. ft. Witron Dry Grocery distribution center of in Terrebonne, Quebec north of Montreal. The new automated distribution center has enabled the closure of a 100,000 sq. ft. warehouse in Riviere du Loup and the conversion of a 120,000 sq. ft. Dry Grocery warehouse in Rouyn-Noranda into a cross dock operation. Sobey’s subsequently invested in a fully automated distribution center in Calgary, Alberta.

- In Canada, Metro has invested in a Witron distribution center in Mississauga Ontario. Loblaws is consolidating a conventional Perishables facility in Ottawa and a conventional Dry Grocery distribution center in Laval Quebec into a new automated Witron facility located in Cornwall Ontario. Walmart Canada is also implementing a new Witron perishables distribution center in the Greater Vancouver British Columbia area.

- Target Corporation constructed a 360,000 sq. ft. perishables and frozen food distribution center in Denton, TX. The facility services 235 stores in Texas and seven other states that were previously serviced by SuperValu (Fort Worth). This is a fully automated case picking system from Wiitron. The facility opened in 2013 and ships approximately 577,000 cases/week. The distribution center employs about 140 people which means the expected throughput rate is 140 cases per man-hour (includes all direct and indirect labor). The comparable throughput rate for a conventional perishables distribution center servicing retail store orders is typically between 60 - 90 cases per man-hour (includes all direct and indirect labor) so there is a significant increase in productivity levels associated with automation. Target must consider this a success as the company has rolled out two more fully automated perishables distribution centers in West Jefferson, OH and Rialto, CA.

|

Witron automated full case selection facility - cases are automatically palletized in store-friendly sequence.

- Meijer has also implemented Witron at its 260,000 sq. ft. x 80’ High distribution center in Pleasant Prairie. This is a 9 COM system that services the companies stores in Wisonsin and Greater Chicagoland which is a relatively new market for the company. The facility went live in February of 2015 and even before the start-up Meijer was already starting work on adding a new Witron distribution center in Lansing, Michigan to replace an existing older Dry Grocery facility. The Lansing facility will be operational sometime in 2017 and will be the company’s largest volume fully automated facility to be serviced by 23 COMS.

- C & S Wholesale Grocers has deployed a new automated robotic picking system in its 500,000 sq. ft. Newburgh, NY grocery distribution center. The facility is a retrofit of what was formerly a conventional Safeway distribution center servicing Genuardis supermarkets. The robotic technology was built by Boston-based Symbotic (formerly CasePick Systems which was acquired by C&S in 2009). The robotic system is positioned in a 30,000 sq. ft. section of the facility and is comprised of a four-story cage within which over 168 “Matrix Rover” robots store and retrieve cases (there are 8 robotic shuttles on each level of the structure x 21 levels spread across 20 aisles). The Rover machine is about the size of a small go-cart and can move as fast as 25 miles/hour. The robots pick (or store) cases by extending 24”-long fingers into the storage location to grab/lift the case from the side and pull it towards its central transfer platform. The robot then moves to a main cross-aisle which acts as a highway for the 8 shuttle carts to transfer cases to designated elevators. From here cases are lowered to floor-level and deposited to conveyor belts. Cases are then palletized by 10’ high robotic gantry arms to form nicely-built 8’ high pallets for ground transport to the stores. The software ensures that cases are pulled in a sequence that corresponds to each specific supermarket’s store-aisle replenishment needs which provides a significant increase in shelf replenishment productivity at retail. C&S is clearly trying to leverage this technology investment , especially in its full case Dry Grocery distribution centers as a solution to handle smaller, slow and medium velocity SKUs. The company is actively competing in the automation industry and has successfully closed several major deals which are confidential.

- In 2007, Denner is a leading Swiss food and beverage discounter that enhanced their distribution center by deploying a Swisslog solution called “CaddyPick” into an existing expanded facility in Mägenwil, Switzerland. Now there are many more automated grocery distribution centers in Europe than we mention in this white paper, but this one is unique so it’s worth mentioning here. The system combines AS/RS for pallet storage and retrieval of 19,300 pallets with a unique semi-automated picking approach that can only be described as an overhead monorail system that transports trolley carriers through pick zones whereby the operator picks cases to the trolley which transports the store’s pallet or roll cage. A video of this operation can be seen if you click here.

Other important automation innovations that are beginning to arrive in the Grocery industry include systems designed to semi-automate the order selection of split case merchandise such as Health and Beauty Care and General Merchandise.

- In 2011, Hy-Vee deployed a Knapp AG A-frame system consisting of 9 automated order picking dispensing machines to automatically dispense pharmaceuticals in its 120,000 sq. ft. HBC/Pharmacy distribution center near Des Moines, IA. The A-frames hold 438 SKUs in vertical channels whereby the A-frames auto-dispense units to a center takeaway belt that deposits them into totes. The SKUs processed by A-frames account for 85% of the order lines shipped (10-15,000 lines per day; 17,300 - 26,400 units per day) whereby the balance of slow moving SKUs are handled manually. The A-frame system has enabled the company to ship 328 - 739 totes/day with 5 people as compared to the previous conventional approach which required 20 people. In short, A-frame throughput is 800 totes per hour with 5 people versus a conventional system that outputs 100 totes per hour with 20 people. In the distribution business we call this a “no-brainer”!

- In April, 2012, the supermarket retailer ASDA contracted with Swisslog to deploy the largest AutoStore installation to date over two phases at its 92,900 m² (1,000,000 sq. ft.) Lutterworth, Leicestershire, U.K. depot. The system will be comprised of 70,000 storage bins and 160 robots, linking eight ergonomic decant stations with a dozen goods-to-man picking ports. Asda is the 2nd largest supermarket chain in the UK (17.9% market share) and is owned by Walmart. Asda services 550 stores across the UK with more than 35,000 products including groceries, clothing, household goods and electronics. AutoStore is a technology that is used to automate the storage and retrieval of split case products.

- Dematic has developed the AMCAP automation system which leverages the company’s shuttle technology. The Dematic shuttle system is used as the picking buffer to support automated full case storage and picking and we expect that this will emerge as a strong solution for automated full case picking applications in the grocery industry. The shuttle technology can also be used as an intermediate buffer for staging mixed-SKU totes that have already been selected, so that the totes are always pulled in store friendly / weight sequence prior to palletization. More importantly, Dematic’s shuttle technology has been widely deployed for semi-automatic goods to man split case picking applications. In this scenario, the first generation design concept has totes containing split case SKUs being presented to order pickers who batch pick a parent quantity from the tote and then put child quantities to six orders that are picked concurrently. The operator remains stationary throughout the pick process which enables a pick rate in the range of 400 - 450 order lines per hour. Multiple grocery retailers are currently investing into this solution including Safeway and Meijer.

- Leclerc is a successful French grocery retailer that has deployed a fully automated Dematic AMCAP system. Delhaize in Europe is also deploying a Dematic AMCAP system.

- The Dematic approach is similar to Witron in terms of receiving, storage, depalletizing, placing cases onto trays and automated pallet building. The main difference is that Dematic leverages shuttle technology to perform the automated case picking function whereas Witron uses its patented Order Picking Machines (OPMs) to do the same work.

- Since 2008, Target and Swisslog have been working together to roll out automation for high volume less than case picking for health and beauty care and general merchandise. To date, Target has rolled out Swisslog’s automation technology at distribution centers in Cedar Falls, IA; Newton, NC; Bakersfield, CA; Rialto, CA; and Amsterdam, NY. Target has since switched to Witron and Symbotic systems for its latest distribution centers.

This article would be remiss if we did not mention at least 4 other automation innovations that have emerged in the Grocery and Foodservice industries.

- The first story of interest is the Nedcon / Dynamic Logistics Systems Order Release Module that began development in 1999 for Albert Heijn in the Netherlands and for ICA in Sweden. The Albert Heijn installation has two modules live in Dry Grocery that automatically select 900 fast velocity SKUs moving up to 6,000 cases/hour from a series of patented conveyor-based pick locations that span 7 vertical levels within each module. ICA’s system consists of 3 modules with 1800 lanes shipping Dry grocery and Fresh Perishables merchandise.

- TGW Systems (TGW GmbH is from Austria) is in the process of moving its skill sets in equipment manufacturing to turnkey systems integration. The comp[any is actively developing an automated case pick solution which will be of interest to the grocery industry. A good video of this solution working in a lab environment in Wels, Austria is available here.

- SSI Schäefer has developed the Schäefer Case Picking (SCP) system which provides a fully automated approach to handling grocery merchandise from receiving through to shipping that can be deployed in both the Dry Grocery and Frozen food environments. A video of this system in action can be seen here. Another video depicting the automated Migros freezer operation in Switzerland can be seen here.

- Lastly, Dematic has developed a unique automation solution specifically for automating the handling of slow moving dry grocery and frozen food SKUs. Sysco has rolled out the Dematic semi-automated approach across 10+ foodservice distribution centers in the U.S. In short, the system is managed by mini-load ASRS cranes that dynamically move standard trays throughout a storage module so that the pick line at floor level is reset with the release of every order wave. The design is based on the reality that out of a population of say 5,000 slow velocity Dry Grocery SKUs, only 1,000 SKUs will be needed on any given order wave. The mini-load cranes set up the pick line in advance of every wave and then operators batch pick orders conventionally at floor level. The approach is a cost effective way of eliminating vertical cherry picking from very narrow aisles which is a very costly and unproductive approach to handling slow moving SKUs in the foodservice and grocery industries. The latest foodservice company to invest in this automation is Ben E. Keith. More information is available on this subject here.

|

Nedcon / Dynamic Logistics Systems Order Release Module at work for Albert Heijn

Looking Ahead to the Future

It appears that North American grocery companies are more interested than ever to understand the business case for automation. The financial case for automation may not necessarily be readily apparent for many companies because the high capital investment requirements are generally returned over a longer time period. The motivation for automation is now being driven by labor-related issues such as: the anticipated forthcoming labor shortage; the very real threat of organized labor shutting down distribution operations such as the 2003 strike that involved 70,000 union workers that hurt the Southern California market (particularly Albertsons, Ralphs, and Vons); and as an overall competitive advantage predicated on shipping more cases with significantly less labor requirements.

Today’s automation technologies are faster, far more reliable and technologically advanced than previous generations. There are pros and cons to automation the companies need to be aware of before considering this option for their business:

PROS (Benefits of Automation or Reasons to Automate)

- Footprint constraints - a land locked site has limited space for expansion therefore constructing a high bay automated facility is a viable option.

- Refrigeration energy savings (“green building”).

- High volume of throughput whereby automation enables a significant labor reduction.

- Depreciation savings enables tax shield cash flows that help justify the investment (such may not be the case in ESOP companies for example).

- The need for consistency and accuracy is compelling.

- Growth in case shipment volume is expected.

- Reduced warehouse damages

- Perfect outbound pallets and higher cube of merchandise per pallet results in transportation savings

- Ability to significantly increase support for a much larger SKU variety since floor space is no longer a constraint for floor-level pick facings.

- Significant retail store labor savings because outbound pallets are built according to each store’s planogram. This may be a hard or a soft savings depending on the retailer but a majority of the pallets arriving at the store will likely need to travel in only 1 - 3 aisles within the store due to the store-friendly pallets that the Wiitron/Dematic systems outputs

CONS (Disadvantages of Automation or Reasons Not to Automate)

- High constraints placed on capital investment requirements - automation requires a much higher upfront investment than a conventional facility. The significant invest requirement versus a conventional facility is such that many firms will not leverage these types of systems if management only invests in projects with a short term ROI.

- Automation cannot handle 100% of the products (e.g. bagged pet foods need to be handled manually). About 15% of the overall case volume may need to be handled conventionally outside of the automated system.

- A high requirement for flexibility to support a dynamically changing environment - automation systems work best in consistent predictable environments.

- Design time constraints - automated systems typically take longer to design and deploy because each one is essentially a custom design effort. It is common that a new facility takes three years to execute.

- High labor requirements for the additional maintenance staff required for each shift of operation in equipment malfunctions or requires proactive maintenance.

Marc Wulfraat is the President of MWPVL International Inc. He can be reached at +1 (514) 482-3572 Extension 100 or by clicking here. MWPVL International provides consulting services to grocery distribution companies seeking to evaluate automation solutions. Our services include: distribution network strategy; distribution center design; material handling and automation design; supply chain technology consulting; product sourcing; 3PL Outsourcing; and purchasing; transportation consulting; and operational assessments.

|