|

Introduction and Company Background

This white paper provides a detailed look at Target's distribution center network and its evolution since the company opened its first distribution center in Fridley, MN in 1969. Target is the fourth largest retailer in the United States and the tenth largest retailer in the world with annual sales of $73.1 Billion in 2013. Target's history dates back to 1902 when George Draper Dayton opened the Goodfellow Dry Goods store in a six-story building in downtown Minneapolis. In 1910, the company changed its name to Dayton Company and over th next five decades the business grew organically under Nelson Dayton’s leadership.

In 1962, the first Target store opened in Roseville, MN and the Target discount chain was launched. By 1968, The Dayton Company had 11 Target stores generating $130 Million in sales revenue. In 1969, Dayton Company merged with Detroit-based J.L. Hudson Company to form Dayton-Hudson Corporation which consisted of Target and five other major retail chains obtained through acquisition. In 1969, Dayton-Hudson Corporation became the 14th largest retailer in the United States and the company went public on the New York Stock exchange.

In the 1970’s Target grew to 80 stores surpassing $1.0 Billion in revenue in 1979. In 1978, Dayton Hudson acquired Mervyn's, a California-based chain of 50 moderate-priced department stores which would later be sold off in 2004. By then end of the decade, Target was Dayton-Hudson’s top revenue-generating subsidiary paving the way for significant growth and nationwide expansion in store count.

Between 1980 - 2000, Dayton-Hudson grew to $33.66 Billion through a combination of organic growth and a series of retailer acquisitions. In 1990, the company acquired The Marshall Field & Company, a Chicago-based department store operator which would eventually be sold off in 2004. In 1995, Target introduced its first SuperTarget store which has a larger footprint (typically in the range of 175,000 square feet) and which offers an extensive product assortment in grocery, fresh produce, bakery, dairy, deli, and frozen foods. In 1998, the company acquired the Rivertown Trading Company, a Minneapolis-based mail-order firm as a means to enter into the e-commerce market.

In January, 2000 the company changed its name to Target Corporation (NYSE: TGT). With 977 Target discount stores (including 30 Super Targets) in 46 states generating $29.7 Billion in sales, Target was poised for continued growth over the next decade. In 2000, the company launched Target Direct as a separate company to oversee Target’s e-commerce business operations (renamed Target.com in 2004). Target.com was originally launched in 2002 based on Amazon’s Enterprise Solutions whereby Amazon provided the order fulfillment services and technology platform for Target’s on-line store front. This partnership would end in August, 2011 when Target.com launched its own platform independent of Amazon. One of the most important events of this decade was the sale of Mervyn’s (257 stores and 4 distribution centers) and Marshall’s (62 stores and 3 distribution centers) for $4.9 Billion in cash proceeds. This important strategic move enabled the company to focus on expanding its Target chain of discount stores rather than expending resources in other areas of the business. Since 2004, Target has achieved consistent organic growth by converting close to 800 traditional general merchandise stores into Expanded Food Assortment stores; by adding over 100 new SuperTarget stores nationwide; and by introducing smaller footprint CityTarget stores.

In 2011, Target launched Target Canada Corporation by acquiring the leaseholds of 189 Zellers store locations across the country. Target Canada kept 125 of the store leases and opted not to acquire the Zellers distribution centers. The first Canadian Target stores opened in 2013. As well, three regional general merchandise distribution centers were built to specification to service general merchandise and apparel to the stores. The Canadian market proved to be more challenging than the company anticipated and start-up operations were challenged with massive inventory shortages at retail stores nationwide. In January 2015, after spending billions of dollars to establish its business operations in Canada, Target formally announced that the company was exiting the Canadian market and closing all of its stores and distribution centers. This decision has resulted in the loss of over 17,600 jobs across the country which is one of the largest private sector layoffs in Canadian history.

Please note that in future we will no longer be updating this information online due to the high rates of plagiarism of this content. People seem to think that stealing digital content is fine but we remain the only accurate source of this data and we have invested significantly to support this project for over 16 years. If there is an interest in obtaining current information available in XLSX format then please contact us and we can provide details regarding the commercial terms. You can reach us by email here.

Overview of Target's North American Supply Chain

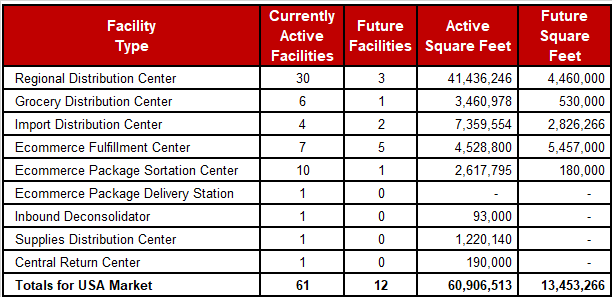

As at 2025 Q1, Target's North American distribution infrastructure consists of the following different facility types:

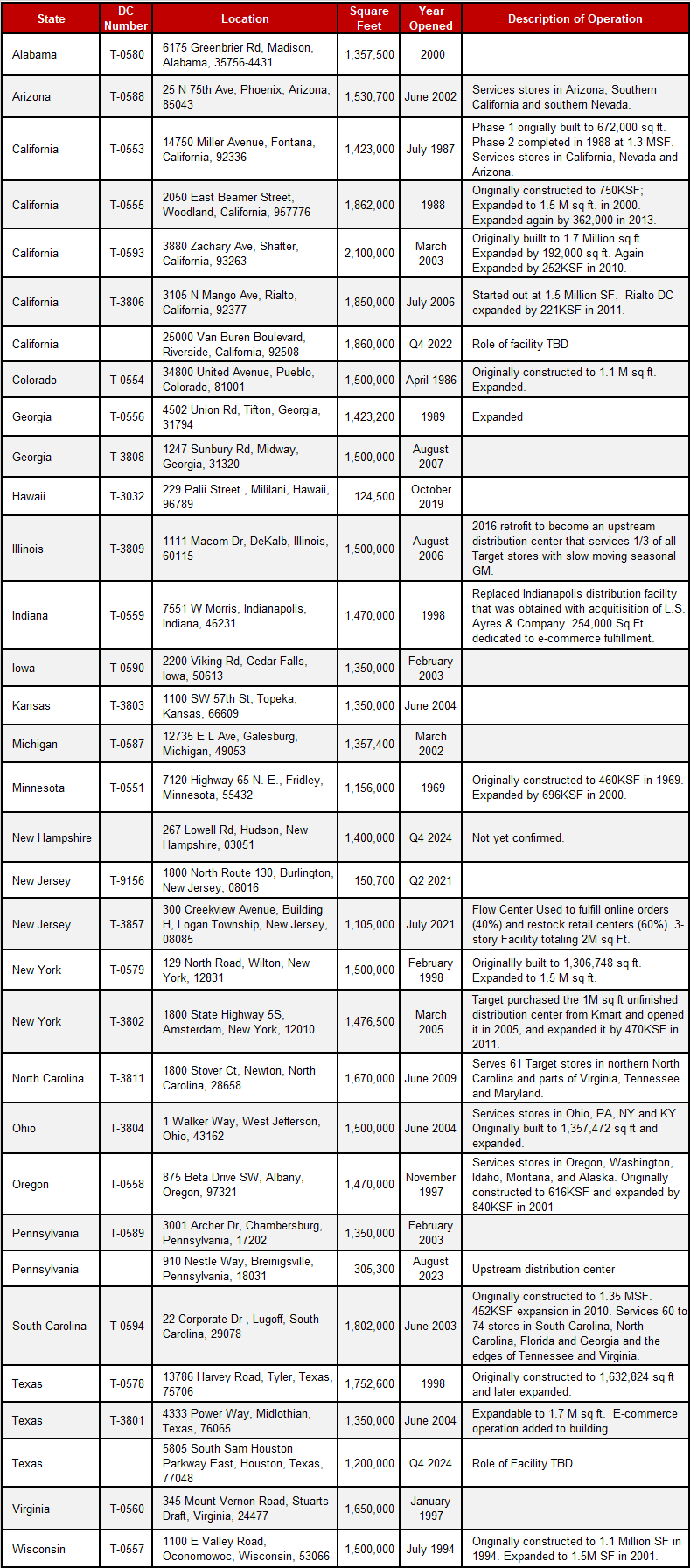

Target Regional Distribution Centers

Domestic vendors flow directly to Target's regional distribution centers when purchased in full truckload volumes. For smaller shipments of less than truckload volumes, Target has established a network of seve n domestic consolidation points run by third party companies. These facilities are not designed for the storage of inventory, rather they serve as a merge in transit point to maximize the number of full truckloads inbound to the regional distribution centers which is an important strategy to minimize the cost of inbound freight in any market that has a large geography to cover. This is similar to Walmart’s Center Point network in that these domestic consolidation facilities act as cross dock terminals. At these facilities, pallets are offloaded and consolidated by regional distribution center such that mixed-vendor full truckloads can be shipped inbound to Target’s regional distribution center and food distribution center network. Target’s primary domestic consolidation points are located in: Fontana, CA; Chicago, IL; Atlanta, GA; Oakland, CA; Sumner, WA; Dallas, TX; and Bergen, NJ. n domestic consolidation points run by third party companies. These facilities are not designed for the storage of inventory, rather they serve as a merge in transit point to maximize the number of full truckloads inbound to the regional distribution centers which is an important strategy to minimize the cost of inbound freight in any market that has a large geography to cover. This is similar to Walmart’s Center Point network in that these domestic consolidation facilities act as cross dock terminals. At these facilities, pallets are offloaded and consolidated by regional distribution center such that mixed-vendor full truckloads can be shipped inbound to Target’s regional distribution center and food distribution center network. Target’s primary domestic consolidation points are located in: Fontana, CA; Chicago, IL; Atlanta, GA; Oakland, CA; Sumner, WA; Dallas, TX; and Bergen, NJ.

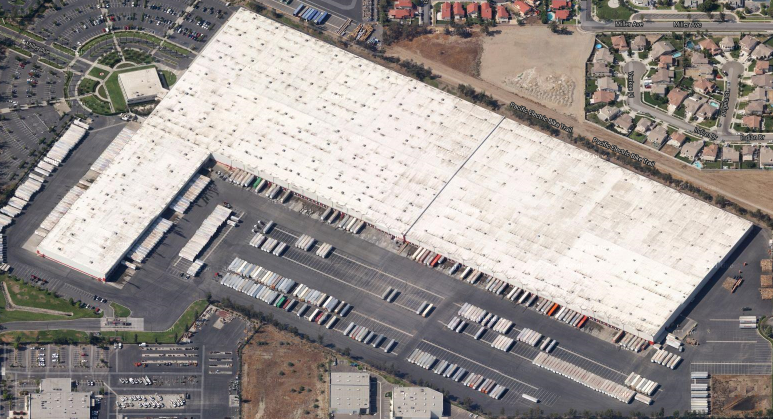

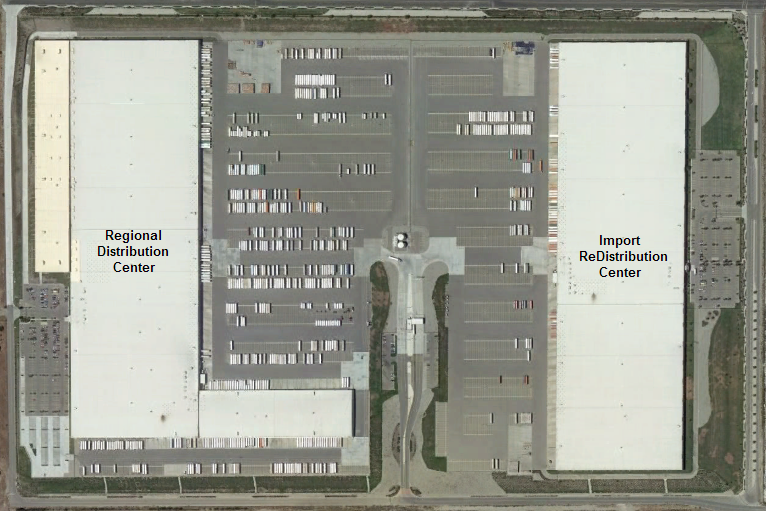

In the United States, Target operates regional general merchandise distribution centers that average 1.5 Million square feet and are easily recognized from overhead by their unique construction which has a wing extension that is typically perpendicular to the main complex. This wing portion of the building is usually sized at about 200,000 square feet and has depth of 260’. The extension has dock doors on either side to support an extensive cross docking operation of fast moving merchandise whereby inbound merchandise is received on one side and outbound loads to the stores are shipped on the other side.

Within the main complex, extensive conveyor systems that are typically 6 - 8 miles long  are used to flow through and sort pre-labeled cases directly from the receiving doors to the shipping doors to minimize handling and manpower requirements. Part of the Inbound dock area is dedicated to a semi-automated process for unloading and sorting freight. Target calls this area ART, for "Automated Receiving Technology." Dock doors on the receiving dock are fitted with powered conveyor systems that extend directly into the trailer. Rather than using a forklift for unloading, workers place all conveyable cartons from the semi-trailer onto a powered conveyor belt where a scanner reads the carton's label and determines whether the carton is Flow Through or Putaway to Reserve. If a carton is Flow Through, the carton is sent via conveyor to an elevated mezzanine, where it is transported until it reaches the outbound shipping lanes which are assigned door per store. If, however, the carton is Putaway to Reserve, it circles around on a conveyor belt so that it is deposited by the same dock door from which it was unloaded. Inbound workers then stack these reserve cartons onto pallets staged for putaway by forklift and/or by an automated AS/RS storage system . Target's regional distribution centers typically employ between 800 - 1,000 associates and are often designed with high-rise Automated Storage and Retrieval Systems for high density pallet storage with the capacity to hold 300,000+ pallets. are used to flow through and sort pre-labeled cases directly from the receiving doors to the shipping doors to minimize handling and manpower requirements. Part of the Inbound dock area is dedicated to a semi-automated process for unloading and sorting freight. Target calls this area ART, for "Automated Receiving Technology." Dock doors on the receiving dock are fitted with powered conveyor systems that extend directly into the trailer. Rather than using a forklift for unloading, workers place all conveyable cartons from the semi-trailer onto a powered conveyor belt where a scanner reads the carton's label and determines whether the carton is Flow Through or Putaway to Reserve. If a carton is Flow Through, the carton is sent via conveyor to an elevated mezzanine, where it is transported until it reaches the outbound shipping lanes which are assigned door per store. If, however, the carton is Putaway to Reserve, it circles around on a conveyor belt so that it is deposited by the same dock door from which it was unloaded. Inbound workers then stack these reserve cartons onto pallets staged for putaway by forklift and/or by an automated AS/RS storage system . Target's regional distribution centers typically employ between 800 - 1,000 associates and are often designed with high-rise Automated Storage and Retrieval Systems for high density pallet storage with the capacity to hold 300,000+ pallets.

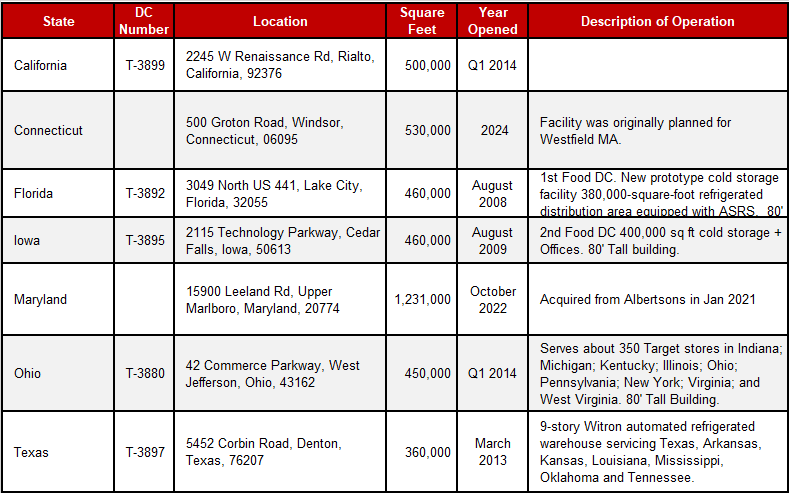

Target Food Distribution Centers

Target operates a separate food distribution network in the United States. Target currently has multiple dedicated perishables distribution centers in the U.S. and this network will likely expand as Target increases the number of stores with an expanded food assortment. Since 2008, Target has gradually been increasing control over its food distribution network by adding automated perishables facilities to replace the use of wholesale distributors such as UNFI/Supervalu. To this end, Target has worked with Swisslog and WITRON to build semi-automated and fully automated perishables distribution centers which are amongst the most advanced in North America.

- Target partnered with Swisslog for its first two perishables distribution centers at Lake City, FL and Cedar Falls, IA. At these facilities the company deployed a technology called the CaddyPick system which is a semi-automated monorail picking system that transports store-specific monorail-suspended trolleys through aisles for order fulfillment. A video of this technology can be seen here. These frozen and refrigerated distribution centers are equipped with a high bay warehouse with 18 stacker cranes to automate pallet putaway and retrieval.

- In 2013, Target opened a fully automated perishables distribution center in Denton, TX. The 360,000 square foot distribution center operates with a system from WITRON Logistik from Germany and is one about a dozen global installations working in a perishables and frozen environment where temperatures range from +34 degrees to a -15 degrees Fahrenheit and building heights reach up to 115 feet. A good overview of this facility is available here. As well, overviews of this automation technology can be found here and here.

- Target has also implemented three WITRON Perishables/Frozen distribution centers in West Jefferson, OH, Rialto, CA and Denton, Texas so we can conclude this automation technology is proving to be cost effective for the company.

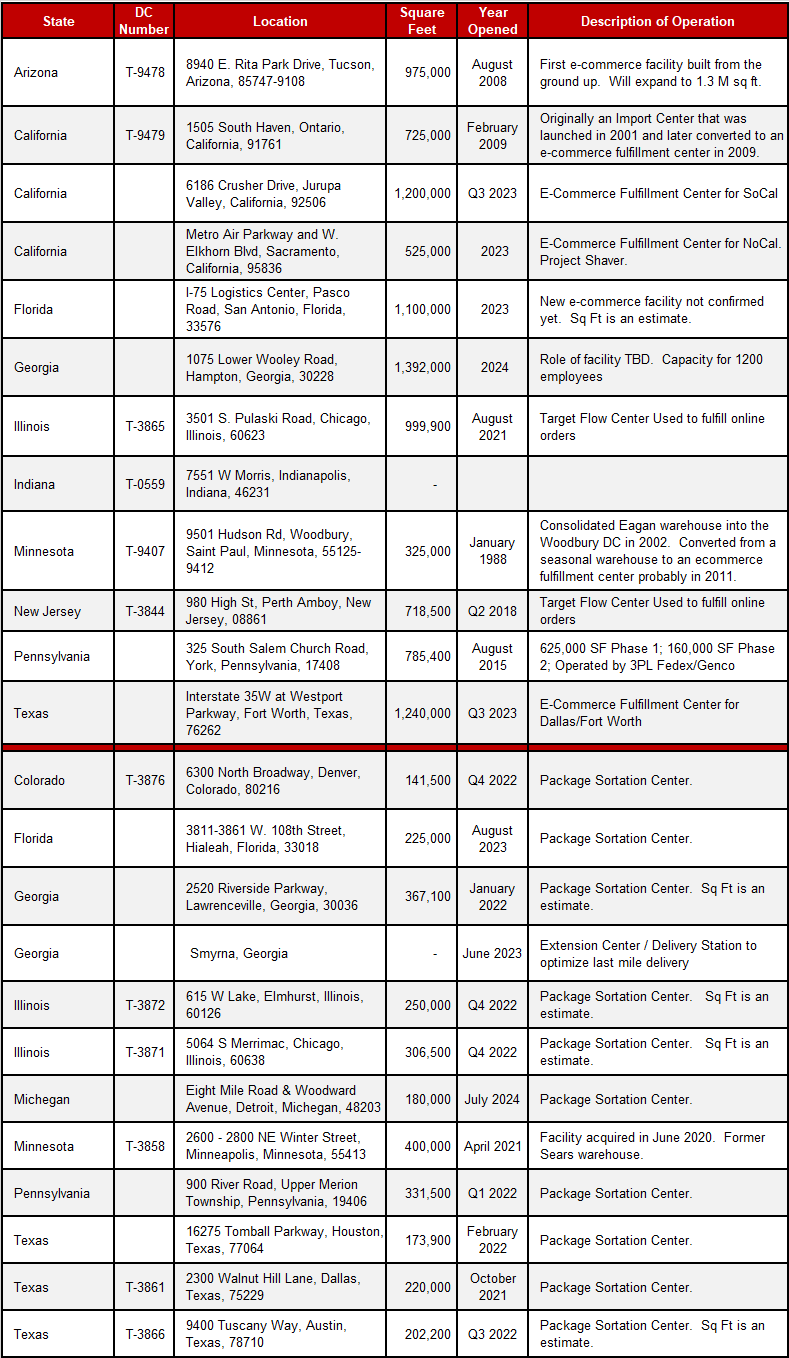

Target E-Commerce Distribution Centers

To support the Target.com business, Target operates multiple dedicated distribution centers. Target has a sizable on-line business and the type of distribution center required to efficiently support e-commerce order fulfillment is different from a retail distribution center. As such, the company has developed a separate network of e-commerce fulfillment centers that operate as separate entities from the retail distribution network.

As well, the company is now adding a network of package sortation centers designed to optimize the last mile delivery for a grouping of stores within a metro market. When online orders are filled from retail stores, the packages are transferred daily to a sortation center for that metro market. From there the packages are sorted into optimized last mile delivery routes to minimize the cost of the last mile delivery.

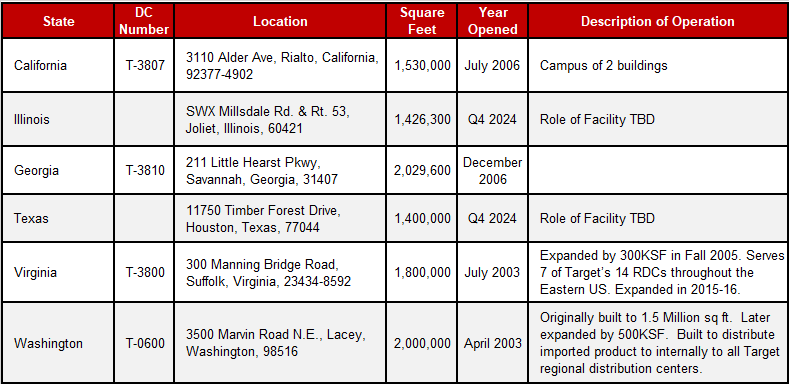

Target Import Distribution Centers

Like most large retailers, Target sources a significant volume of import merchandise (e.g. general merchandise, apparel, footwear, toys, etc.) from different countries around the world. Published estimates are that Target imports about 500,000 containers of merchandise produced in countries like China, Indonesia, Vietnam, India, and Thailand. Through the use of overseas consolidators, Target merges overseas goods to ensure full container loads are shipped to North America. These import containers arrive at domestic ports in: Seattle/Tacoma, WA; Los Angeles/Long Beach, CA; Norfolk, VA; Savannah, GA; Oakland, CA; Newark, NJ; and Prince Rupert, BC.

Import containers are either shipped from the ports to a network of seven de-consolidators run by third party companies, or directly to the company's four import warehouses. Five of the de-consolidators are positioned near major ports of entry: Sumner, WA; Carson, CA; Norfolk, VA; Savannah, GA; Oakland, CA; and two are inland: Chicago/Elwood, IL; and Dallas, TX. Ocean containers handled by the de-consolidators are essentially de-stuffed, sorted, and loaded into full-size 53’ trailers to be shipped into the domestic Target distribution network which consists of import redistribution warehous es and regional distribution centers. es and regional distribution centers.

In 2001, Target first introduced its first import redistribution warehouse into its network once the concept was proven to be an effective strategy by Walmart and K-Mart. The import warehouse serves as an important inventory buffer where import merchandise is stored until such time that it is needed by the regional distribution centers. Some people might consider this concept to be inefficient as it introduces another stocking point within the distribution network which adds cost penalties for handling and storage. While this is true, Target’s 4 import warehouses prevent the 26 regional distribution centers from being flooded with inventory that is not needed in the short term. This in turn improves the deployment of inventory within the network and also increases the efficiency and use of the regional distribution centers. It also minimizes inbound transportation expense to the regional distribution centers by ensuring that all transfers are shipped as full truckloads.

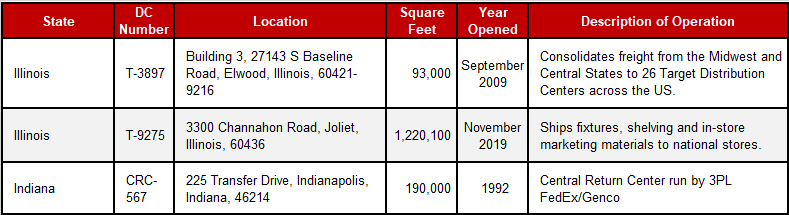

Target Specialty Distribution Centers

Specialty distribution centers include consolidation, store supplies and returns processing centers. As far as reverse logistics is concerned, Target stores generally send palletized returns back to a subset of regional distribution centers or LTL hubs where goods are consolidated and shipped to a centralized returns processing center located in Indianapolis, IN. This operation is run by FedEx (Genco division) which has a strong track record in operating returns processing facilities.

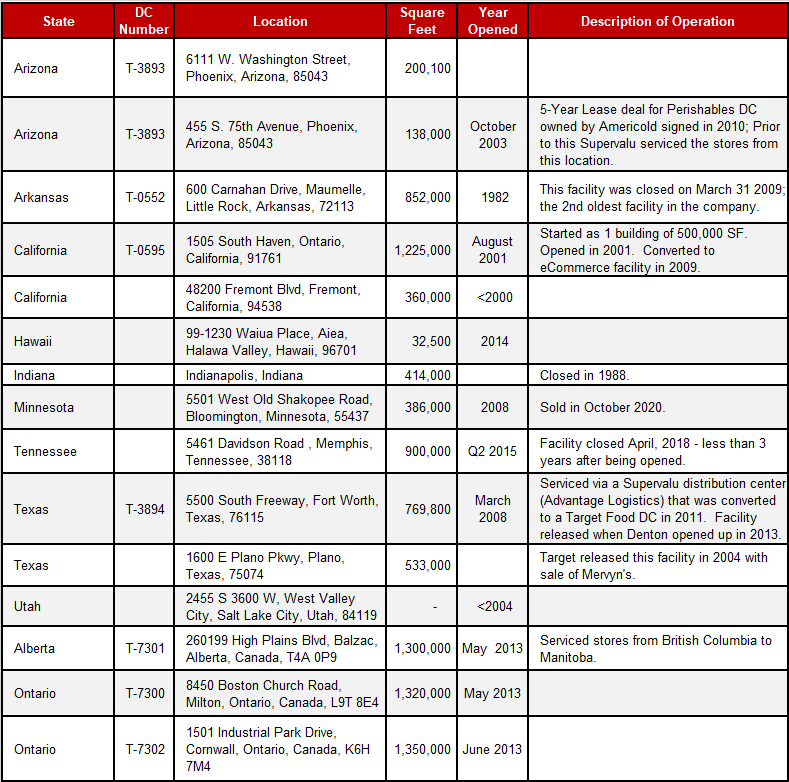

Target Distribution Centers That Have Been Vacated

Since Target introduced its first distribution center in 1969, the company has vacated several distribution centers. A list of the facility closures that we are aware of follows and there may be others which are off the record.

Maps and Graphs

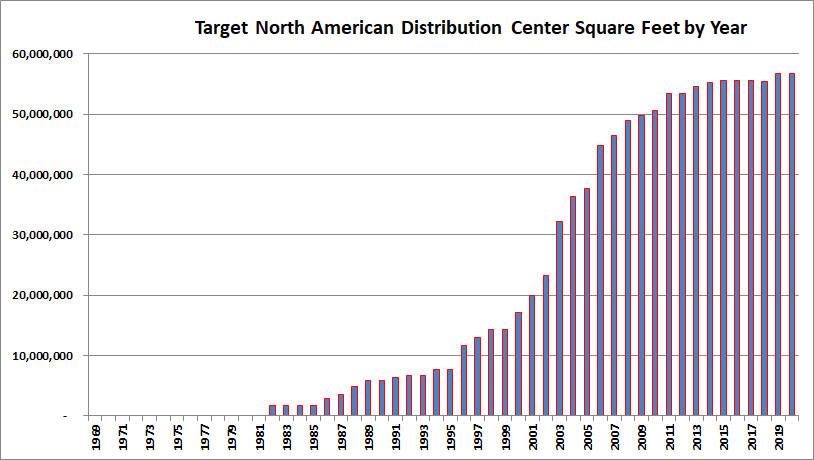

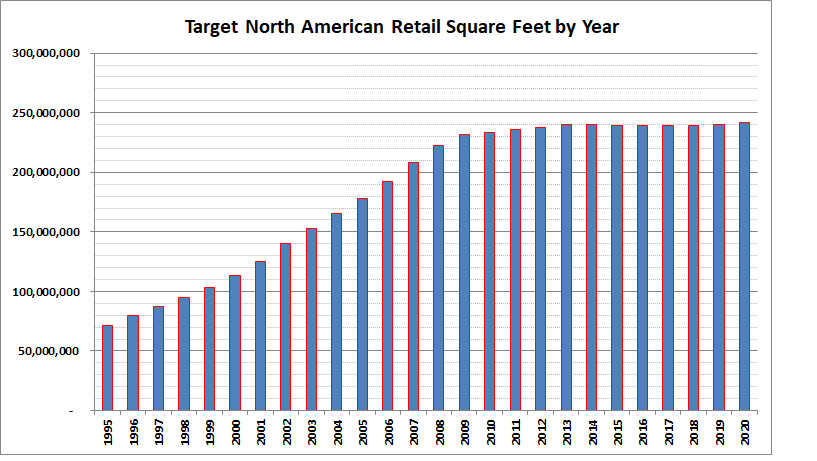

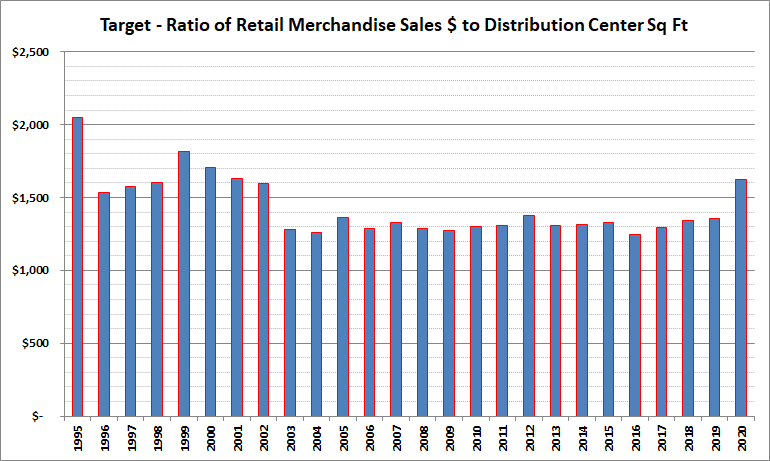

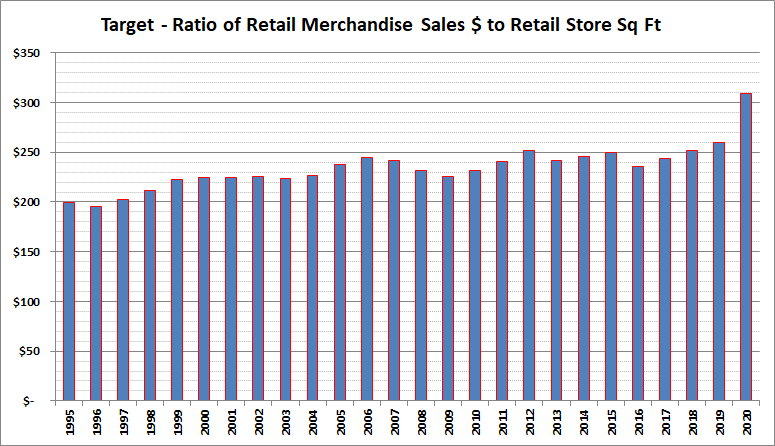

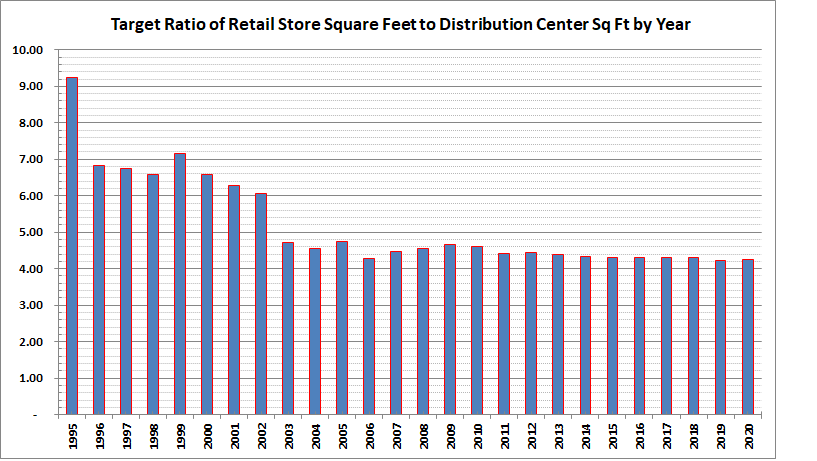

Target’s North American distribution network is depicted in the map below. As well, Target’s growth in distribution center space is depicted in the graphs below where one can visualize the rapid increase in distribution capacity between 2002 - 2010. We also provide a unique graph that depicts the relationship between Target’s retail store square footage per distribution center square footage over the time period where this data is available. Note that these graphs exclude all square footage and retail sales revenues related to other operating companies such as L.S. Ayres & Company; Mervyn's and Marshall Fields and revenue. As well, charts showing retail sales revenues are for merchandise sales from Target stores only and exclude credit card revenue.

Key Learnings- Interpreting the Analytics

The above charts are sourced from Target’s annual statements and they help to illustrate several key learnings about the value of having distribution space to support a retail business. In our experience, there are still many retail executives who do not fully understand the critical importance of having a strong supply chain to support the retail stores. The typical thinking is that it is better to invest capital into opening new stores to increase sales revenue than it is to sink money into distribution infrastructure which will only drive up expenses. In fact, companies that strategically invest into distribution infrastructure recognize that increasing market share can only be achieved if the overall operating expense structure to effectively support the stores is maximized for efficiency at all times.

- From the above charts we can see that Target has 4.8 square feet of retail store space for every square foot of supporting distribution center space. That same figure for Walmart in the U.S. is currently running at about 6.2 which is an interesting set of figures. In the mid-2000 time period Walmart was closer to 5.4 and since then this figure has been on the rise. This tells us that this ratio should gradually improve over time as distribution infrastructure leverage is improved.

- Target’s retail merchandise sales per square foot of retail store space is information that is publicly available and closely watched but retail sales as it relates to distribution space if not something that people pay attention to. Partly this can be explained because many retailers outsource portions of their supply chain to third parties so the distribution space requirements are difficult to compare without having a detailed understanding of how each company operates which is typically not disclosed information. For example, Target outsources all import de-consolidation and domestic consolidation work to specialized third party companies. Technically if this distribution space is dedicated to Target then it should be included in their distribution infrastructure requirements. We have excluded these facilities because (a) we have incomplete information about these facilities; (b) these facilities are typically much smaller buildings relative the rest of the distribution centers in the network; and (c) these operations may or may not be shared 3PL facilities where space allocation is shared between several companies The bottom line is that the estimation of distribution space requirements is not an exact science so information is never perfect.

- Lastly, based on our research, Target has $1,437 retail merchandise sales revenue per square foot of distribution center space. By our estimates, that same figure for Walmart is running closer to $2,750. Now one may erroneously draw a conclusion from these two data points to say that Target has too much distribution space to support its business, but in fact the exact opposite may well be the case. Why is this?

- First off, it is always dangerous to compare the effectiveness of retail supply chains by using the value of the merchandise being sold as part of a performance metric. If a retailer has sales revenue generated from pharmaceuticals or from fuel sales then these revenues are very high with minimal impact on distribution space or cost requirements which can significantly distort comparative data.

- Secondly, the type of product categories being sold at the retail stores drives revenue dollars. To illustrate this point using a ridiculous example, we could compare the retail sales revenue per square foot of distribution center space for a dollar store retailer versus a home hardware retailer. The fact that the home hardware retailer sells much higher value merchandise will cause their retail sales per square footage of distribution center space to appear much better than the dollar store company.

- The percentage of volume being sourced to the stores through the direct store delivery (DSD) channel also has a direct impact on this ratio. The higher the percentage of merchandise that is supplied as DSD, the less the need for distribution infrastructure, but in fact DSD may be an inefficient way to move goods to market and the retailer may be losing margin as a result. Similarly, by outsourcing the distribution of certain product lines to wholesalers, the need for distribution capacity is reduced but this may also result in reduced margins

- Clearly, the comparison of sales revenue per square foot of distribution space is not all that meaningful of a statistic for retail executives to compare.

This discussion serves to point out the potential for consulting firms to mislead companies through the use of comparative supply chain industry benchmarking data. The supply chain strategy that works for one company may be a disaster for another company. Clearly, the onus is on each company to have sharp critical thinkers within their supply chain management organization who question the validity of the facts and figures being presented for all aspects of the decision making process. This is particularly true for capital investment decisions that are based on promises for big savings that may or may not ever pan out.

Target's Supply Chain - Predictions for the Future

This discussion looks ahead to where potential opportunities may exist to strengthen the Target North American supply chain. The information below is 100% based on our opinions, conjecture and market experience in working with retail distributors and has no relationship at all to any factual information.

- Currently there exists already a number of retail grocery companies that are significantly smaller than Target that self-distribute pharmaceuticals and particularly generic drugs. Walmart has established a dedicated supply chain for the self-distribution and reverse logistics of pharmaceuticals products. We expect that it makes economic sense for Target to move in this direction given that this concept has already been fleshed out by others.

- The Target food distribution network is still in its infancy relatively speaking. We expect that the company will continue to invest into adding highly automated Perishables/Frozen Food distribution centers in key market areas where the distance between the existing food distribution center network and the stores is highest. The most obvious example of this is that Target stores in the Northwest of the U.S. are a significant distance from the nearest food distribution center which is in Rialto, CA. Similarly, stores in the Northeast of the country are a long distance from the perishables distribution center in Cedar Falls, Iowa. The transportation savings associated with moving distribution closer to market will be critical to provide competitive prices for food merchandise.

- We also expect that Target will continue to invest into its e-commerce distribution infrastructure to increase speed to market as Amazon continues to drive other retailers in this direction.

Lastly, we feel it is important to say that Target is considered an excellent operator and a solid leader within the retail supply chain industry. Target is willing blaze unproven trails by making investments into innovative technologies and particularly distribution automation technologies. At the same time, Target takes great care to protect its corporate image and the company spends a significant amount of energy and resources to take decent care of its employees. We see this balance as being essential attributes to maintain into the future to keep out of the hot water that has been highly problematic for some competitors. The reality is that being a good corporate citizen towards a company's associates, particularly the people who do the heavy lifting in the distribution centers, will take on much greater importance in the future due to the increasing media attention and public awareness of the distribution industry as a whole.

Legal Disclaimer

We have researched Target’s distribution network because we are supply chain experts who are interested in sharing how the world's most successful companies strategically distribute goods to market. Within the retail industry, Target is widely considered to be a strong operator and our intent is to provide insight to supply chain professionals. All information within this white paper was sourced from publicly available material. In preparing this material, MWPVL International Inc. has not intentionally or knowingly disclosed any private or confidential company information.

MWPVL International Inc. does not represent Target nor do we have a business relationship with Target. This is a research paper for educational purposes only. The information assembled in this research paper is intended to provide the reader with intelligence on the subject of world class strategies for distribution networks. MWPVL International Inc. has made every effort to ensure that the information contained within this white paper is as accurate and as up to date as possible. However, it is important to note that distribution networks change over time and for this reason there is a possibility that information contained within this paper may be out of date or inaccurate. If you wish to submit any information to improve the quality of this white paper, please be sure to send us some feedback. Conclusions

Marc Wulfraat is the President of MWPVL International Inc. He can be reached by clicking here. MWPVL International provides supply chain / logistics network strategy consulting services. Our services include: distribution network strategy; distribution center design; material handling and automation design; supply chain technology consulting; product sourcing; 3PL Outsourcing; and purchasing; transportation consulting; and operational assessments.

|