|

Canadian Grocer Blog Entry: October 3, 2014 (here)

One of the undisputed leaders in the e-grocery business is Tesco. They have a very interesting story to tell about their on-going journey to achieve success with their dotcom depots in the United Kingdom. In this month's entry, I thought it would be interesting to share this story with some valuable learnings from the front line.

Tesco.Com

Tesco is one of the top three retailers in the world with 2013 annual turnover of £70.9 Billion Pounds. The company initially launched its dotcom business in 1996 and formally registered Tesco.com as a separate business in 2000. Today, Tesco.com has an estimated annual turnover of £4.3 Billion. The UK happens to have the second highest online grocery market penetration in the world at 5.1%.

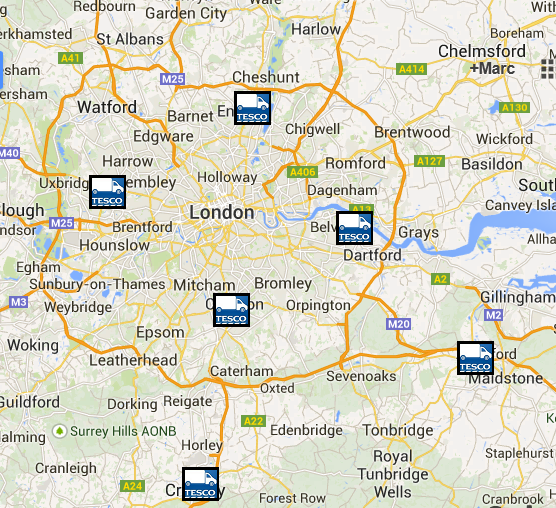

Although Tesco’s primary dotcom operations are based in the UK, particularly in the greater London area, Tesco has also successfully exported their dotcom strategy to other countries including Poland, Czech Republic, Thailand and South Korea. Most importantly, Tesco is one of the few companies that operates a profitable dotcom grocery business.

Tesco allows customers to place orders from any computer, mobile device, smartphone and even from virtual shopping walls in the subway. Within the UK, Tesco offers customers the ability to “click and collect” (i.e. customer places order online and picks up the order at a local Tesco store drive-through). Tesco also offers a home delivery service in certain parts of the country where the company can provide a home delivery based on a customer's preferred 1-hour time slot. Since its launch, Tesco.com has fulfilled 170 Million orders within the UK and expectations are that growth will rapidly surpass the company's existing distribution capacity over the next 5 years.

In the beginning, Tesco fulfilled online orders from designated retail stores which the company calls ‘dark stores’. Customers place orders the evening before and beginning at about 4:00am, Tesco associates travel through the store aisles with trolleys to pick and pack the orders. Delivery vans are loaded out of the back room of the store after all orders are picked so that routes can be planned and with as many deliveries as possible.

The dark store strategy was inexpensive to launch and also scalable so it quickly expanded to over 300 stores nationwide. But the strategy was not perfect. The weaknesses of fulfilling customer dotcom orders from retail stores are summarized below:

- Fulfilling dotcom orders at retail stores is highly inefficient and labor intensive. The typical dark store processes 220 orders/day with 9 delivery vans requiring 70 associates to manage the effort.

- The back rooms of the stores are much smaller in the UK as compared to North America due to the high cost and low availability of space. Stores are not set up to support the efficient management of a high volume of dotcom orders. Optimizing the delivery routes is difficult at best under these circumstances.

- The typical store assortment is 20,000 items versus the range of 30,000 SKUs offered on the Tesco.com site. This creates limitations on what the customer is allowed to order from the store and also adds complexity due to product restrictions that differ for each store.

- Most importantly, the fact that the store aisles have Tesco associates picking dotcom orders at the same time that in-store customers are shopping creates an inherent conflict. In-store shoppers ultimately become turned off at having to compete for aisle space and for inventory on the retail shelf. The result is an unexpected downturn in retail store sales from in-store shoppers for ‘dark stores’ performing dotcom fulfillment.

These issues led Tesco to seek a new business model to support their dotcom business. This strategy currently consists of a combination of dark stores to service remote regions of the country, and dedicated dotcom depots to service densely populated urban markets such as London. As time goes by, the pendulum will swing away from retail stores to dedicated depots which are more cost effective to serve the online market.

In 2006, Tesco launched its first dedicated dotcom depot in Croydon on the south side of London. This was the company's first generation dotcom facility and it was designed with completely manual processes. Order pickers push carts through a warehouse that stocks items in low height shelving bins. The depot has a similar floor plan to a retail store layout. Associates pick customer orders across the dry grocery, chilled and frozen temperature zones. The pick cart holds 6 totes such that the associate reduces travel time by picking 6 orders simultaneously. Sortation of totes into delivery van route/stop sequence prior to loading is a manual process. Tesco drivers perform the deliveries using a private fleet of vans – something that the firm considers to be very important since these drivers are the face of the company as they have direct interaction with the consumer. With first generation depot, the job was done but not very efficiently.

In 2008, Tesco introduced a second depot in Aylesford and in 2010 a third depot in Greenford with the goal to establish distribution points on all sides of the London market. The depots are fed from Tesco regional distribution centers to ensure efficient procurement and inbound transportation operations.

This second generation fulfillment center maintained the same warehouse layout utilizing standard bin shelving at floor level to stock products. Operators use pick carts to pick 6 orders concurrently with the use of a hand-mounted RF scanning device to increase order accuracy. At the end of the pick run, the cart is staged in a shipping lane. Totes are then manually placed onto to a powered conveyor which transfers the totes into a short term storage buffer. This buffer storage system is automated with multi-shuttle robotic carts that automatically transfer totes into and out of the buffer. As soon as the outbound routing of the delivery vans is done and the delivery vans are ready to be loaded, the automated shuttle system releases totes to a conveyor system that transfers the totes to their assigned truck doors. The release of totes is sequenced by temperature zone (frozen, chilled, ambient) so that the chilled totes are always placed closest to the nose of the delivery van closest to the refrigeration unit. As well, totes are sequenced to enable the driver to load the truck in reverse-delivery sequence (i.e. the first delivery is the last to be loaded). These investments in mechanization and automation enabled a 38% increase in productivity over the first generation of depot.

In 2012, Tesco opened a fourth depot in Enfield followed by a fifth depot in Crawley in 2013. Tesco continued to improve the efficiency of their distribution operations with this third generation depot that improved picking efficiency across all temperature zones. The manual pick cart was replaced with a mechanized conve yor system to reduce order picking travel time. yor system to reduce order picking travel time.

As in the past, each customer order is picked into a tote but now the tote is conveyed throughout the depot such that it is transferred only into the aisles (i.e. zones) where a stocked item needs to be picked for a customer order. Once all the items in a given aisle are picked, completed totes are transferred by conveyor to the next zone, or if the tote is completed, it is transferred to a multi-shuttle storage buffer. Given that associates are now assigned to pick zones, the fundamental challenge of this type of operation is to ensure workload balancing across all aisles so that each associate has approximately the same workload to manage. This requires slotting software to ensure that the fastest moving SKUs are equally spread out amongst all of the operating aisles.

Not content to rest on their laurels, Tesco launched their sixth dotcom depot in 2013 in Erith (120,000 square feet). This fourth generation depot introduced a significant advancement in automation in the form of goods to person (GTP) order picking. Approximately 70% of the entire ambient product variety is now stored in an automated robotic multi-shuttle system. Chilled and frozen products are unchanged from the mechanized third generation depot.

The fourth generation process flow is described below at a high level:

- As Dry Grocery products are received into the depot, they are removed from vendor cartons and placed into a standard donor tote. This enables all products to be held within a standardized entity which is an important requirement for an automated material handling system.

- Totes are conveyed from receiving to a mini-load automated storage and retrieval system (ASRS) which transfers the pairs of totes into a storage buffer. This enables the automated putaway and storage of incoming goods.

- A robotic multi-shuttle system is then used to bring goods to order pickers who work at fixed picking stations. The multi-shuttle receives incoming totes from the ASRS system whenever it needs to be replenished with inventory. The multi-shuttle system is designed to manage inventory for a couple of days of customer orders whereas the mini-load ASRS system is designed to hold the rest of the inventory in the depot.

- As customer orders are released to the warehouse, the multi-shuttle robotic carts automatically pull totes from the storage system. Each vertical level of the storage system is patrolled by an electric multi-shuttle carrier robot that is responsible for moving totes into and out of the storage locations within its vertical level. By having a robotic shuttle cart working in every vertical level within an aisle, this introduces a much higher throughput capability. The multi-shuttle system also enables the ability to store a much higher variety of products within the depot because the assortment of products can be stored vertically to the full height of the building, rather than being stored at floor level only.

- From 8:30pm to 5:30am, the multi-shuttle robots pull donor totes holding inventoried products and transfer them to ergonomically-designed picking stations. At each picking station, an order selector picks 6 orders concurrently (3 customer totes are positioned to the left and to the right side of where the donor tote arrives). A combination of put to light technology and computer displays enable the fastest picking productivity combined with the highest levels of order accuracy.

- Completed totes are pushed off to a conveyor and returned to the same multi-shuttle system that is used to store donor totes holding inventoried products. This is perhaps the most interesting and intelligent use of automation because the multi-shuttle system is actually dual-purpose. It serves as a storage buffer for items that need to be picked; and it also serves as the storage buffer and sortation system for completed customer orders that are awaiting release to the delivery vans in temperature / route / reverse stop sequence. Since picking wraps up at 5:30am, the tote sortation and release process to load out the delivery vans starts at this time. This means that the multi-shuttle robots can be efficiently utilized first to support the Goods to Person order picking process, and then afterwards to support the tote sortation process to move completed orders into the delivery trucks in the required sequence.

The results of this fourth generation depot provided an 82% improvement in labor productivity as compared to the first generation depot. As importantly, the higher level of automation is a key enabler for Tesco to move towards providing profitable same day delivery service. The current business model is primarily a next day delivery service and Tesco is seeking to up the ante by moving to same day delivery in future.

All in all, it is a remarkable story and one that is not yet finished. Looking ahead, Tesco will likely continue on its brilliant journey to increase the efficiency of its dotcom service by introducing goods to person automation for perishables and frozen food. With 6 dotcom depots now in operation and undoubtedly more to follow, the company will most likely be looking at better ways to efficiently feed these facilities to minimize the inventory assets within the dotcom distribution network. As dotcom shipping volumes increase, it will become increasingly difficult for Tesco’s regional distribution centers to support replenishing both the retail stores and the dotcom depots. Instead, a Centralized Fulfillment Center (CFC) will be introduced as a dedicated distribution center for centralized procurement and inbound transportation and the CFC will feed the dotcom depots on a daily replenishment basis.

The lessons learned from Tesco’s success at the e-Grocery business are summarized below:

- The use of retail stores to fulfill dotcom orders is a good initial way to get started in the e-grocery business because it is low cost and quickly scalable. However it is an inherently inefficient method to fulfill dotcom orders. Since each store offers a different assortment of products, this method imposes restrictions on the product variety that can be ordered by the dotcom customer. The use of the store back room to perform logistics operations is difficult and constrained due to a lack of space. Lastly, it is also a turn-off for in-store shoppers who now have to compete with retail store associates for aisle space and retail shelf inventory. Ultimately there is a decline in same store sales turnover for stores that perform dotcom fulfillment as a result.

- Dedicated dotcom depots make the most sense when they are positioned close to high-density high-income urban markets where efficient delivery routes can be organized. In Canada, markets like Toronto, Vancouver and Calgary make good candidates for online service.

- Dotcom depots must remove ‘the fingerprints’ to enable a profitable business model. The handling of retail units is labor intensive and various types of automated material handling systems such as mini-load ASRS systems and goods to person picking systems are being used to maximize the efficiency and accuracy of the distribution center. While these systems are expensive to acquire and deploy, they significantly reduce labor expense at the depot. As importantly, these technologies enable a much higher product assortment to be distributed from the depot because they make full use of the vertical height of the building. These automation systems also enable automated sortation and release of customer totes to delivery vans based on exactly how the vans need to be loaded out which further improves efficiency.

- Maintaining control over the outbound transportation function is critical to the success of the customer experience. The truck drivers represent the face of the company when they interact with the consumer and outsourcing this function to a third party is no different than outsourcing the associates who work in the retail stores. In effect, the driver becomes an extension of the store in the mind of the customer.

- The efficient purchasing and feeding of inventory to dotcom depots is typically done by initially leveraging existing retail distribution centers that are already in place to support the stores. The dotcom depot simply becomes another store that needs to be replenished with inventory. As the network of dotcom depots increase, it may make sense to establish a dedicated centralized distribution facility dedicated to replenishing just the dotcom depots. This of course depends on geography and demand volumes so this strategy may or may not make sense depending on whether or not the network of dotcom depots are close together or spread far apart.

Marc Wulfraat is the President of MWPVL International Inc. He can be reached by clicking here. MWPVL International provides supply chain / logistics network strategy consulting services. Our services include: supply chain network strategy; distribution center design; material handling and automation design; supply chain technology consulting; product sourcing; 3PL Outsourcing; and purchasing; transportation consulting; and operational assessments.

|